ETH Price Prediction: Analyzing the Path to $5,500 and Beyond

#ETH

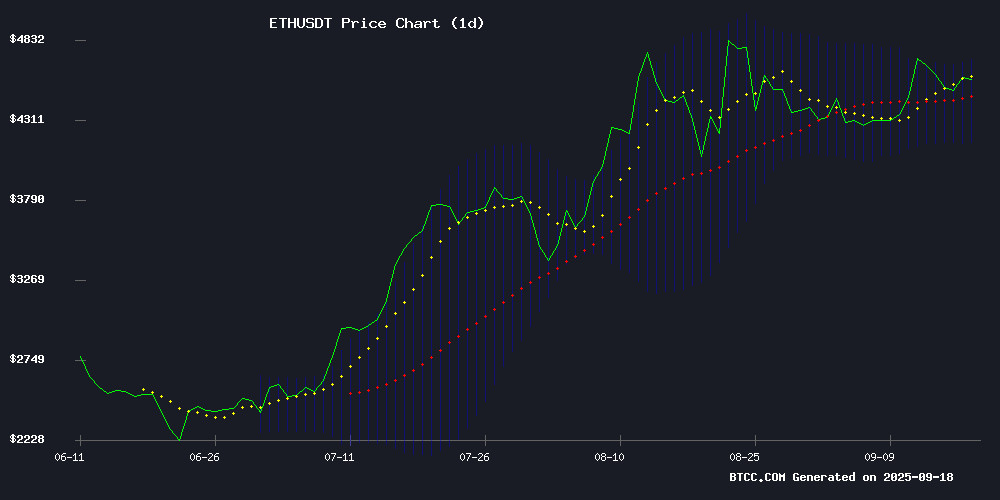

- Technical Strength: ETH trading above 20-day moving average with Bollinger Band support suggests bullish consolidation pattern

- Whale Accumulation: Large investors are accumulating positions despite mixed market sentiment, indicating confidence in long-term value

- Infrastructure Growth: Partnerships like Eigen Labs with Linea and record stablecoin liquidity enhance Ethereum's ecosystem utility and value proposition

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

Ethereum is currently trading at $4,591.02, positioned above its 20-day moving average of $4,432.78, indicating underlying strength. The MACD reading of -39.11 suggests some near-term bearish momentum, though the price remains within the Bollinger Band range of $4,160.75 to $4,704.82. According to BTCC financial analyst Olivia, 'ETH's ability to hold above the 20-day MA while trading in the upper half of the Bollinger Band configuration suggests consolidation with a bullish bias. A break above $4,705 could trigger momentum toward $5,000 levels.'

Market Sentiment: Institutional Accumulation and Infrastructure Growth Support ETH

Recent developments show ethereum whales accumulating positions amid diverging market views, while Eigen Labs' partnership with Linea enhances Ethereum's infrastructure through restaking solutions. The record $171 billion in stablecoin liquidity and upcoming Ethereum World's Fair in Buenos Aires demonstrate growing ecosystem strength. BTCC financial analyst Olivia notes, 'The combination of whale accumulation, institutional partnerships, and record liquidity creates a fundamentally strong backdrop for ETH. While short-term volatility may persist due to the $11.3 billion staking exit queue, the overall trajectory remains constructive for new all-time highs before 2026.'

Factors Influencing ETH's Price

Ethereum Whales Accumulate Amid Diverging Market Views

Ethereum whales have aggressively expanded their holdings, adding 820 ETH worth approximately $3.8 billion within 72 hours. Wallets holding 10,000 to 100,000 ETH now control 31 million coins, signaling strong institutional demand. This surge coincides with preparations for spot ETH ETF launches, potentially fueling further price momentum.

Market observers remain divided on Ethereum's trajectory. While whale accumulation suggests bullish sentiment, prominent analyst Benjamin Cowen warns of impending volatility. "The real altseason hasn't begun," Cowen notes, predicting Ethereum will underperform Bitcoin until November based on historical patterns. The asset must sustain prices above $4,772 to invalidate bearish technical formations.

Institutional flows continue to shape Ethereum's market structure. With a $554 billion fully diluted valuation, ETH's movement increasingly reflects macroeconomic forces rather than retail speculation. The coming weeks will test whether whale confidence can override broader market cycles.

Ethereum (ETH) Shows Bullish Signals for Potential New All-Time High Before 2026

Ethereum's market dominance remains unchallenged, with a $553.46 billion capitalization and $47.58 billion daily trading volume. The altcoin's price action at $4,585.25 reflects a 2.04% gain, testing resistance at $4,598.42. A breakout could propel ETH toward $4,800, while failure to hold $4,504.82 support may trigger a retreat to $4,250.

Technical indicators reinforce the bullish case. The moving average sits comfortably at $4,307.70 beneath current prices, while MACD's golden cross signals accelerating momentum. Ethereum's entrenched position across DeFi, NFTs, and institutional portfolios continues to drive speculative interest amid market volatility.

Eigen Labs Partners with Linea to Enhance Ethereum Infrastructure Through Restaking and EigenCloud

Eigen Labs, a leading Ethereum infrastructure developer, has joined forces with Linea to bolster network security and utility. The collaboration introduces restaking—a novel mechanism enabling staked ETH to secure services beyond Ethereum's native chain. This innovation allows developers to repurpose existing stakes for enhanced security and faster application deployment.

Sreeram Kannan, Eigen Labs' founder and CEO, positions the partnership as a catalyst for Ethereum's scalability. "Linea will be a force multiplier for the scale and utility of Ethereum," Kannan stated, underscoring the project's role as an ETH accelerator.

The EigenCloud platform delivers critical infrastructure for Linea developers, featuring EigenLayer for optimized ETH yields. This strategic alignment between two key Ethereum ecosystem players signals growing sophistication in layer-2 solutions and staking derivatives.

Ethereum Price at Crossroads: Whale Activity Signals Potential Volatility

Ether faces a critical juncture as on-chain data reveals whales sitting on profits reminiscent of November 2021's cycle peak. The cryptocurrency gained 2% following the Federal Reserve's 25 basis point rate cut, breaching $4,600—yet this upward momentum appears fragile.

CryptoQuant data shows mid-sized whale holdings mirroring unrealized profit levels last seen at all-time highs. With addresses holding 10K-100K ETH already offloading 100,000 tokens this week, analysts warn of mounting selling pressure. Michael van de Poppe notes failure to sustain upside momentum could trigger a drop below $4,000.

The market watches two divergent paths: a retest of $5,000 resistance or correction toward $3,000 support. Whale behavior remains the decisive factor—their continued distribution of 90,000 ETH since Q1 suggests weakening conviction at current valuations.

Ethereum Stablecoin Liquidity Hits Record $171B as Price Targets $5,500 Breakout

Ethereum (ETH) is trading near $4,605, consolidating below a key resistance zone while buyers defend crucial support levels. Short-term exponential moving averages have bolstered the asset's resilience, maintaining a constructive trend despite broader market caution ahead of the U.S. Federal Reserve's policy decision.

Analysts project a potential breakout to $5,500, citing a descending triangle pattern breach as a bullish signal. Ethereum's stablecoin circulation has surged to $171 billion, reinforcing its position as a focal point in crypto markets this week. Historical data suggests ETH could gain 12% following expected Fed rate cuts, mirroring post-2022 trends.

Ethereum Price Coils for Potential $800 Swing as Volatility Reaches Multi-Month Lows

Ethereum's price action has entered a phase of extreme compression, trading within a razor-thin $4,200-$4,500 range. Bollinger Bands and Average True Range indicators signal the tightest volatility conditions seen in months—a classic precursor to explosive movements.

The symmetrical coil pattern suggests an imminent breakout in either direction, with technical analysts projecting an $800 swing. A decisive close above $4,500 could propel ETH toward the psychologically significant $5,000 level, while failure to hold $4,200 support may trigger a retracement to $3,600.

Market participants remain cautiously positioned, with liquidity clustering around both boundaries. The current consolidation follows Ethereum's characteristic volatility cycles, where prolonged compression periods typically resolve in dramatic trending moves.

Ethereum Foundation and Columbia University Launch $6M Blockchain Research Center

The Ethereum Foundation has partnered with Columbia Engineering to establish the Columbia-Ethereum Research Center for Blockchain Protocol Design, backed by up to $6 million in funding. The initiative will allocate $500,000 annually over its first three years to advance core blockchain infrastructure development and academic research.

Tim Roughgarden, a renowned computer science professor and blockchain protocol expert, will lead the center. "We are thrilled to launch this partnership to advance foundational principles for blockchain," said Columbia Engineering Dean Shih-Fu Chang. The collaboration marks a significant institutional push into blockchain protocol innovation.

Ethereum World’s Fair in Buenos Aires to Showcase Blockchain Innovation

The Ethereum World’s Fair, scheduled for November in Buenos Aires, will highlight groundbreaking blockchain innovations across eight specialized districts. Organized by the Ethereum Foundation, the event aims to demonstrate Ethereum’s potential to replace traditional systems with decentralized solutions.

Inspired by historical World’s Fairs that debuted transformative technologies like the telephone, this iteration will feature dedicated zones for DeFi, gaming, AI, and decentralized social applications. The DeFi district will showcase alternatives to traditional banking, while the Social district explores DAOs and community-governed platforms.

Hardware and wallet infrastructure will form another focal point, underscoring Ethereum’s expanding ecosystem. The fair represents a strategic moment for ETH as institutional interest in blockchain solutions accelerates globally.

Ethereum Nears Local Bottom as Binance Open Interest Declines

Ethereum's struggle to breach the $5,000 mark in August 2025 has kept investors on edge, but recent data hints at a potential turnaround. Futures market dynamics and dwindling exchange reserves suggest ETH is building a foundation for its next upward move.

Binance's Ethereum open interest has historically signaled local bottoms. Analysts note a 14.9% average OI drop precedes price stabilization, with spot corrections averaging 10.7%. The latest September 13 decline from $11.39 billion to $10.4 billion suggests further downside to $9.69 billion may complete the bottoming pattern.

Water150 Unveils Historical Satra Brunn Well with Blockchain-Backed Water Tokens

Water150, a project by the Longhouse Foundation, has unveiled its first natural water well, Satra Brunn, one of Sweden's oldest and best-preserved springs. Located in a 324-year-old village, the well will secure 66 million liters of mineral water annually starting in 2027, each liter backed by a Water150 token issued on the Ethereum blockchain.

The initiative leverages blockchain technology to create a transparent ecosystem for natural water springs. The first batch of 66 million Water150 tokens will correspond to the annual supply from Satra Brunn, marking a novel intersection of traditional resources and decentralized finance.

Vitalik Buterin Defends Ethereum's 43-Day Staking Exit Queue as $11.3B Awaits

Ethereum co-founder Vitalik Buterin has addressed mounting concerns over the network's staking exit queue, now exceeding 43 days. In a Sept. 18 post, Buterin framed the delay as a deliberate security feature rather than a flaw, comparing validator commitments to military service. "An army cannot hold together if any percent of it can suddenly leave at any time," he wrote, emphasizing Ethereum's reliability depends on preventing instant validator exits.

The backlog currently holds $11.3 billion in staked ETH. Buterin acknowledged room for optimization but warned against naive reductions that could compromise network trustworthiness. His stance aligns with EigenLayer founder Sreeram Kannan, who described the exit period as a "conservative parameter" critical for mitigating coordinated attacks.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity. The cryptocurrency is trading above key technical support levels while benefiting from strong institutional accumulation and infrastructure development. The record $171 billion in stablecoin liquidity provides substantial ecosystem support, and partnerships like Eigen Labs with Linea enhance Ethereum's utility through restaking solutions.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $4,591.02 | Above 20-day MA |

| 20-day Moving Average | $4,432.78 | Support Level |

| Bollinger Upper Band | $4,704.82 | Resistance Target |

| Stablecoin Liquidity | $171B | Record High |

BTCC financial analyst Olivia emphasizes that while short-term volatility may occur due to the staking exit queue, the combination of technical strength and fundamental growth drivers positions ETH for potential movement toward $5,500. Investors should consider dollar-cost averaging and maintain a long-term perspective given Ethereum's ongoing infrastructure development and institutional adoption.